We love a good acronym here at Momentum Advisory! You’ve likely heard of the terms ‘customer acquisition cost’ (CAC) or ‘customer lifetime value’ (CLV or LTV)? In certain sectors, such as technology you’ve probably gone a step further, and can likely calculate, these values. If not, it’s a good idea to get a handle on these numbers, as they have enormous value for businesses of every type and size.

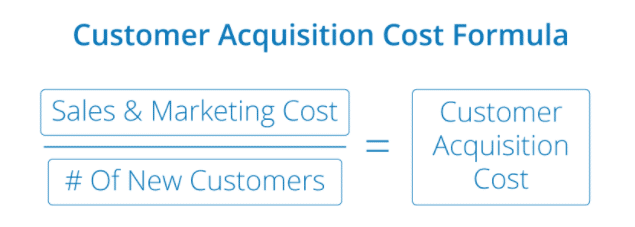

CAC is how much you spend to acquire a customer. Simply put, it’s the amount you spend on sales and marketing divided by the number of customers you get during the period you’re measuring.

CLV is the net value of a customer to the company. That is, how much money a customer spends during their entire relationship with you, minus the costs of products and services they buy.

Used together, these numbers help drive your overall business strategy, including your marketing approach.

To illustrate, here’s an example we can all relate to, Netflix – one of the most popular media streaming services on the planet. One tactic that helped Netflix become such a popular brand was that they made adopting the service a risk-free move by offering a one month free trial.

This free trial represents a portion of Netflix’s customer acquisition costs. For simplicity’s sake, we’ll pretend those are the only acquisition costs. A quick look at the price points on the Netflix homepage will show you that the basic Netflix subscription costs €7.99 per month which, being the price that Netflix is giving up to provide this free trial, would be Netflix’s CAC in this example.

Next we will turn to Netflix’s customer lifetime value. A quick search tells us that in 2017 Netflix had a churn rate of 9.7% (they increased prices and lost users). If we reduce that number slightly (as the dust has likely settled in the months since then), we can use a round 8% for our example calculations. Using a monthly churn rate of 8%, we can calculate that the average customer will stay with Netflix for 12.5 months (1/churn rate = customer lifetime). Combining this customer lifetime with the price of a Netflix subscription leaves us with a customer lifetime value of 12.5 x €7.99 = €99.88

So with a customer lifetime value of €99.88 and an acquisition cost of €7.99, Netflix is looking at about a 12.5:1 CLV to CAC ratio. Now, we have simplified this down however. A brand like Netflix has advertising and marketing costs that should also factor into their CAC, but, at a high level you can see what the calculation is designed to do.

There’s no rule of thumb or ideal ratio that we can speak of here. Ideal will be different depending on your business, your offering, frequency of purchase, selling mode, it goes on. What you should remember is that the CLV:CAC ratio shouldn’t be too low. 1:1 would indicate it costs as much to acquire the customer as you end up making from them, hardly worth the effort, nor a sustainable model for growth.

The beauty of CLV is that in many cases it can be unlimited. Keep delivering value that your customers seek, profitably, is a sure fire way to keep growing your business.

No matter what business you’re in, you can figure out your CAC and CLV and use the numbers to support or change your strategies and tactics. If you’re in professional services, use the numbers to understand if you need to focus on getting more repeat business or acquiring new customers. If you sell products in a brick-and-mortar store, the numbers will help you plan your promotional budget and adjust your product mix. If you’re a local services business–plumbing, car repair, landscaping, etc.–you can use your CAC and CLV values to determine how much you should spend on marketing to new customers versus providing better service to current clients.

Getting a handle on these metrics can help you answer critical questions like:

- How much should I budget for marketing based on the goals I have for gaining new customers this quarter/year?

- How much should I be investing in customer delight, customer experience, and customer support?

- Where should I focus my sales team and how should I structure their compensation plans for the results I want?

- Which products or services should I concentrate on to get the customers I want to work with, and who are also profitable for our company?

We hope you found this post useful. If you need a helping hand telling your CAC’s from your CLV’s or you want to develop a strategy based on your current or desired metrics, contact us on scale@momentumadvisory.ie